This is a method of value investing. It isn’t day trading, where one seeks to make a profit on price movements in a single day. Studies show that less than 10% of day traders are successful. I’m comfortable holding shares as long as they represent a solid investment.

Overview

- Make these investments with pods of money you can afford to lose. In my case, I invest in single stocks $2,000 at a time in a brokerage account.

- If you make frequent trades, you’ll have paperwork hassles at tax time unless you have automated import of brokerage transactions, which I use in TurboTax.

- To identify stocks to purchase, run a screener based on modified stock purchase criteria from the American Association of Individual Investors Model Shadow Stock Portfolio User’s Guide.

- If a stock makes the screener list, research the stock to make sure it’s viable. I don’t buy Chinese stocks and wish to buy in sectors that I feel are overlooked. Most days that I run the screener there is nothing worthwhile to buy.

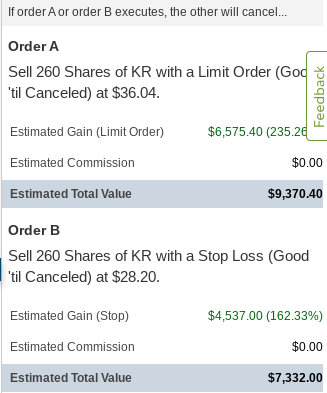

- Once the stock is purchased, immediately place a bracket order on the stock, which is a limit order to lock in a gain and a stop-loss order to prevent excessive loss. Most of the time, I will set the limit order at 15% to 20% gain and the stop loss at 10%. This frees you from monitoring the share price.

- Monitor the pods at least every two weeks. If you’ve held a stock for two weeks and it has risen 13% you might want to cancel the bracket order and sell at the current market value.

Criteria

| Measurement | Rationale |

| Price/Book ratio less than 1 | This means that for every dollar of stock price there is at least one dollar of book value in the company. |

| Market capitalization $20M to $750M | Smaller cap stocks are usually better for individual investors who aren’t competing in the market with institutional investors. |

| Security price greater than $4 a share | Bad things can happen to a company when share prices drop below $4 a share. |

| Price/Sales ratio less than 1.2 | Low Price/Sales can indicate good value. |

| Price/Earnings ratio for next year less than 12 | High Price/Earnings indicates a company is overvalued. |

| Equity Summary Score from StarMine greater than 4 | Stocks are given a rating from independent research providers. Zero to 3 is bearish, 3 to 7 is neutral, 7 to 10 is bullish. This measurement is available from Fidelity Investments. |

| Profit Margin from trailing 12 months greater than 2% | Shows consistency in generating some profit. |

| Profit Margin in the most recent quarter greater than 2% | Shows profitability recently. |

Example

On 12/12/2020, 11 stocks met the whole set of criteria. To this set, I added Facebook, Exxon, and Apple to show how these popular stocks measure up to the screener. The report:

Apple’s Price/Book ratio is 31 and Price/Earnings is 28. It is not a good value investment at all. Based on the report, I’d take a closer look at CUBI and COWN. DAC shot up 9.45% the prior day. If I’d run the screener the day before, I might have bought DAC then.

Placing a Bracket Order

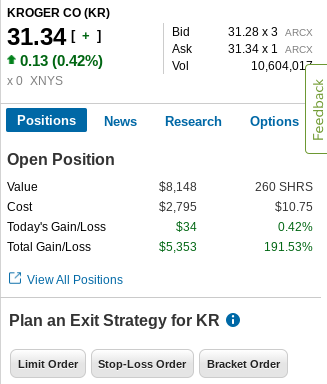

Here is an example of creating a bracket order for Kroger stock, with a limit gain of 15% from today’s price and a stop-loss of 10%. Select “Set Exit Plan” and then select the Bracket Order button to create the two linked orders.

Many factors influence share prices and there are no guarantees of gains. However, using this approach based on measurements can yield good returns.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.